The Election Today You Probably Aren't Paying Attention To ... But Should Be

Will Energy Prices Wake Up The Once-Sleepy Race For Public Service Commission?

Good Morning. Today is election day in several states.

Virginia and New Jersey will elect governors and state legislators.

New York, Boston, Atlanta, and Miami will elect mayors.

And California will decide on redistricting.

These are the races the political class will have their eyes on. But there is another slate of races we are watching more closely: elections for the Public Service Commission (PSC) in Georgia.

This is the first time AI infrastructure is on the ballot.

The PSC (or Public Utility Commission as it is called in other states) is an oversight body for utility companies. When a utility suggests a rate hike, they need to get approval from the state PSC/PUC.

Traditionally, this has been an arcane and technocratic process. Utilities are regulated monopolies, so when it comes to rate setting, their proposals are often ushered through.

That might be changing.

It’s been well documented that electricity prices are rising. And the data center buildout is catching some heat for it. Bloomberg recently reported on the sharp increases in electricity prices, particularly in areas near data centers.

So far, we haven’t seen a lot of public polling on data centers and their relationship with energy costs specifically. But the concern of food, housing, and energy costs outstripped other economic factors, such as the job market, in a recent Pew poll. And an undisclosed battleground poll reported on by Axios showed “A plurality of voters in each of the eight states said that they have an unfavorable impression of the AI industry ... that AI will make their energy costs higher …”

Other recent articles have suggested energy prices (and by extension, data centers) could be the sleeper issue in several of the races we highlighted above. And in the DC-area, some negative ads in Virginia’s delegate races are exclusively focused on data centers.

Although, it will probably be a stretch to identify a direct correlation between the data center + energy issue and the outcomes in New Jersey and Virginia as those governor races are usually a more general bellwether of the national political climate. For example, during the Virginia gubernatorial debate, only one question was asked of the candidates on this issue.

That is why the PSC races in Georgia could be instructive as to the salience this specific issue has with voters. Joe Brettell, an energy communications and policy expert in Texas, told us that who wins or loses these races isn’t what he’s watching. Instead, it’s overall voter turnout. If these races see a significant uptick in voter turnout, that could be the canary in the coal mine showing that this issue is energizing voters. Policymakers, tech leaders, and utilities should take notice.

We’ll save our thoughts on what operational change at PSCs/PUCs might look like until after today’s results. It’s also very possible this election comes and goes with little additional attention.

But it’s safe to say if a sleepy Public Service Commission race sees more people motivated to vote, you can only imagine what’s to come in 2026 at the intersection of energy and AI. That is, unless plans are designed, constructed, and communicated to build more energy and distribution before then.

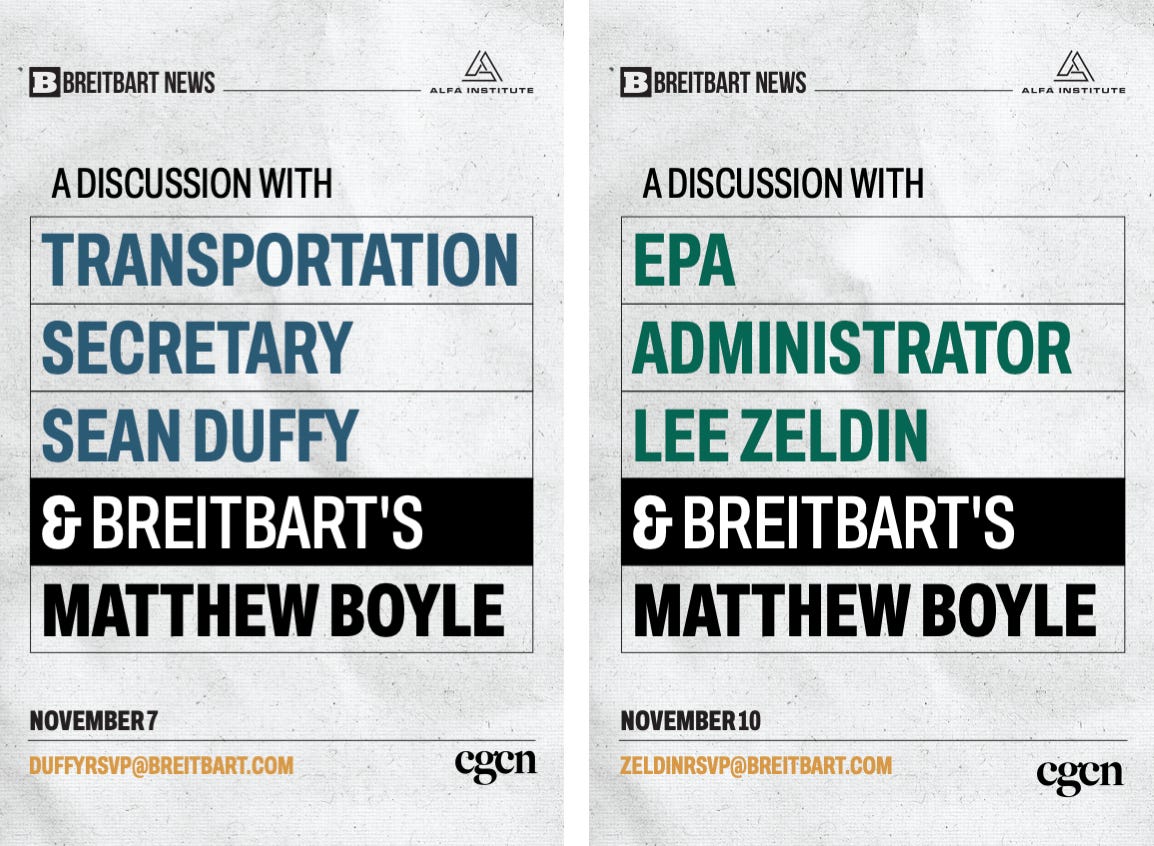

Upcoming Events

ALFA, Breitbart News, and CGCN are hosting two events with cabinet officials over the next seven days. If you’d like to join us, please email us at duffyrsvp@breitbart.com and zeldinrsvp@breitbart.com.

Magnets Made in America, With Uncle Sam as Co-Owner

Yesterday Vulcan Elements and ReElement Technologies announced a $1.4B deal focused on rare-earth magnet production. The startups secured backing from the Department of War and Commerce to build a 10,000-ton magnet facility, securing production of a critical technology on U.S. soil; irreplaceable components to motors and every advanced defense platform from drones to fighters. China currently controls the inputs and equipment across this supply chain.

The Department of War’s Office of Strategic Capital is lending $620M, Commerce is putting in $50M and getting equity. Both agencies are taking warrants, or claims on future equity if the deal performs. This deal uses a wide array of the tools the administration has in the toolbox, necessary to solve what is a truly wicked problem without government as both a customer and backer.

China imposed strict export controls on rare earths late last year and added magnet-specific restrictions in April. Commerce Secretary Lutnick says the goal is making America’s supply chain “strong, secure, and perfectly reliable.” With 10,000 tons of annual capacity, this deal could be the beginning of real alternatives to Chinese production. Trump recently said tensions with China over rare earths “has been settled.” Domestic production keeps it that way.

ReElement focuses on processing end-of-life magnets and otherwise wasted electronics into high-purity rare-earth oxides, Vulcan is the company that domestically converts those into finished magnets. Vulcan’s CEO John Maslin, a former Navy officer, opened their first commercial facility in March. They’ve already delivered magnets to defense and tech customers.

Field Note

The Public Servant Profile

As we get deeper into the Administration’s term, the work of political appointees gets more important and interesting. For many of these folks, it has been about six months since they started. Their mission and how to execute it is coming into sharper focus.

There is a deep pool of successful, private sector leaders that have entered the Administration and their approach to the job makes for an interesting case study for anyone that has worked in government.

In fact, it’s one of our favorite types of profiles to read. Here are two recent pieces worth reading: