The Only Way Through Is To Build

The SBA's Return As Startup Steward, A16Z's NDAA Initiative, and Ending Short-Term Thinking In Public Markets

Good morning. Our tribute to Charlie last week has helped us answer a nagging question rattling around our brains: “What are we going to do to make our communities and country a better place?” We all have our corners of the world that we occupy and can impact. For us, the answer lies in Charlie’s legacy. We are going to build, boldly.

One of the strongest pulls toward purpose is building something. And here’s the beauty: building is all around us. A company, product, legislation, media, or coalition all apply.

Supporting and advocating for the policy work that encourages more building is why ALFA was started.

It’s fitting that this week both the House and Senate are focused on a similar mission through their oversight and legislative work regarding the Small Business Administration’s capital allocation programs. We dig into that below.

The SBA's Return As Startup Steward

The Small Business Administration has delivered Washington's rarest accomplishment: fixing something that's broken. After hemorrhaging $397 million in taxpayer dollars last year—the first loss in 13 years—new SBA Administrator Kelly Loeffler has restored the agency to its zero-subsidy foundation while actually increasing lending volume.

Today, the House Small Business Committee has a hearing with Thomas Kimsey, SBA's Associate Administrator for Capital Access, that will showcase an important shift in federal lending philosophy. Gone are the Biden-era fee holidays and relaxed standards that turned America's small business lending backstop into a free-for-all. In their place: rigorous underwriting, restored fees, and a commitment to fiscal discipline that's already bearing fruit.

The Numbers Tell the Story

Since January 20, SBA has approved 14% more loans compared to the same period in 2024—approximately 53,000 loans totaling $28.3 billion. This is not despite tighter standards, but because of them. When lenders know the federal backstop maintains discipline, they lend with confidence.

The technical changes read like a return to sanity: collateral required above $50,000 (down from $500,000), 10% equity injections are required for startups and ownership changes, and mandatory IRS transcript verification.

The new standards explicitly require all owners, guarantors, and key employees to be U.S. citizens, nationals, or lawful permanent residents. The Franchise Directory, which helps distinguish legitimate franchises from predatory schemes, has been reinstated. And veteran applications get priority processing.

America First, Actually

What's happening at SBA mirrors the broader Trump administration approach: treat government programs like investments, rather than entitlements. Zero-subsidy doesn't mean zero support; it means sustainable investment that doesn't require annual Congressional appropriations or taxpayer bailouts.

This is about ensuring American small business lending serves American small businesses. The tighter underwriting standards create a quality floor that benefits everyone: borrowers avoid overleveraging, lenders reduce losses, and taxpayers stop subsidizing dubious endeavors.

The Biden administration's loosening standards and waiving fees created the illusion of access while undermining the program's sustainability. Real access means building a system that works indefinitely, as opposed to one that requires emergency interventions when losses mount.

The Big Picture

Rebuilding American manufacturing, powering AI infrastructure with new energy development, and keeping America ahead of global competition all require a thriving small business ecosystem that is built on solid foundations.

SBA lending is a key piece of the capital stack of American enterprise, and Secretary Loeffler is stewarding it well.

***

RELATED: Last night, the House passed an extension of the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs.

A16Z Launches Dynamic Tech Defense Reform Initiative

In support of needed reforms in this year’s NDAA, the leading venture capital firm has engaged founders, policymakers, and former military officials in a concerted effort to change how we buy better weapons and systems.

As you read here last week from former HASC staff director, Chris Vieson, one of those reforms is the need for commercial first mandates in our procurement process. Other priorities outlined by the initiative include:

Portfolio Acquisition: Let the Pentagon buy what works, not what a bureaucrat chose years or decades ago.

Past Performance Requirements: Reward merit, not incumbency.

Expanded Definition of Non-Traditional Defense Contractors: Slash red tape for start-ups trying to serve their nation.

Procurement Workforce Reform: Align incentives to fix a risk-averse culture.

From their launch essay:

These reforms would return us to an acquisition system that helped win WWII and seeded Cold War-era tech dominance. They would unlock innovation, expand opportunities for thousands of U.S. businesses, and rapidly deliver the best products to our warfighters.

Perhaps most important of all, they will help usher in an industrial renaissance for the American people. A revitalized defense industrial base means new factories, better jobs, and durable middle-class careers anchored in innovation and production. These reforms can reignite American manufacturing in towns hollowed out by decades of offshoring and neglect.

Read the full piece here.

Going Long on Long-Term Building

For years we have heard calls for this reform, which also reflects our sentiments above: it’s time for less paperwork and processes and more production.

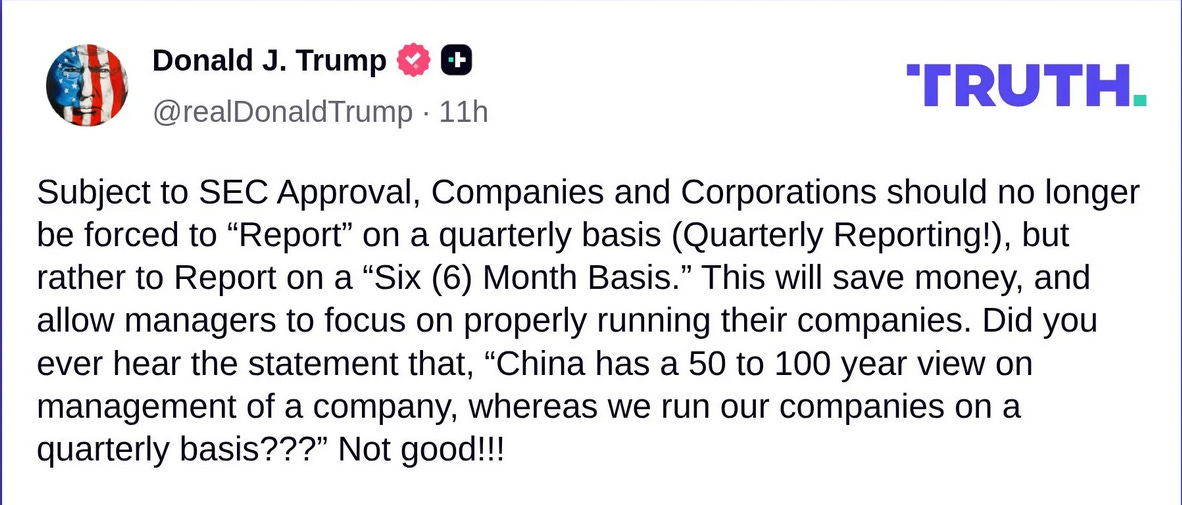

Last week, the Long Term Stock Exchange, announced its formal petition to the SEC “to allow public companies to report earnings semi-annually instead of quarterly.”

The WSJ reports:

The group thinks such a move could revive the shrinking number of public companies, which some see as an existential threat for the American economy and investors.

The number of publicly traded companies in the U.S. is about 3,700 as of late June, down roughly 17% from three years ago, according to the Center for Research in Security Prices. That number has roughly halved since its peak in 1997.

A stronger foundation for public companies means more room to build for the long term.