What Washington's Missing With China's AI Play

Technology and competition strategists in Washington are watching for Huawei data centers that may never materialize while the Chinese technology company is focused on executing a distributed AI strategy that leverages its existing telecommunications ecosystem to embed AI capabilities throughout global infrastructure.

A range of policymakers in Washington, including those who would restrict the sale of American products, are misreading the competitive landscape. If we’re not careful, the conventional wisdom of measuring computational power will miss the more meaningful measurement to Huawei: market capture. We should not build walls while they build networks.

First, The Production Reality

The production capacity of Huawei's chips far exceeds official estimates. Washington believes that Huawei can produce ~200,000 Ascend chips (which are essential for workloads such as deep learning) annually through Chinese semiconductor foundry, SMIC.

But Chinese media claims that Huawei delivered 210,000 these advanced chips in just the first quarter of 2025.

Financial analysts have projected that 700,000-1,000,000+ Ascend units are shipping this year.

Moreover, the assumption is they have 2-3 million stockpiled TSMC-fabricated Ascend 910 dies from the pre-sanctions era.

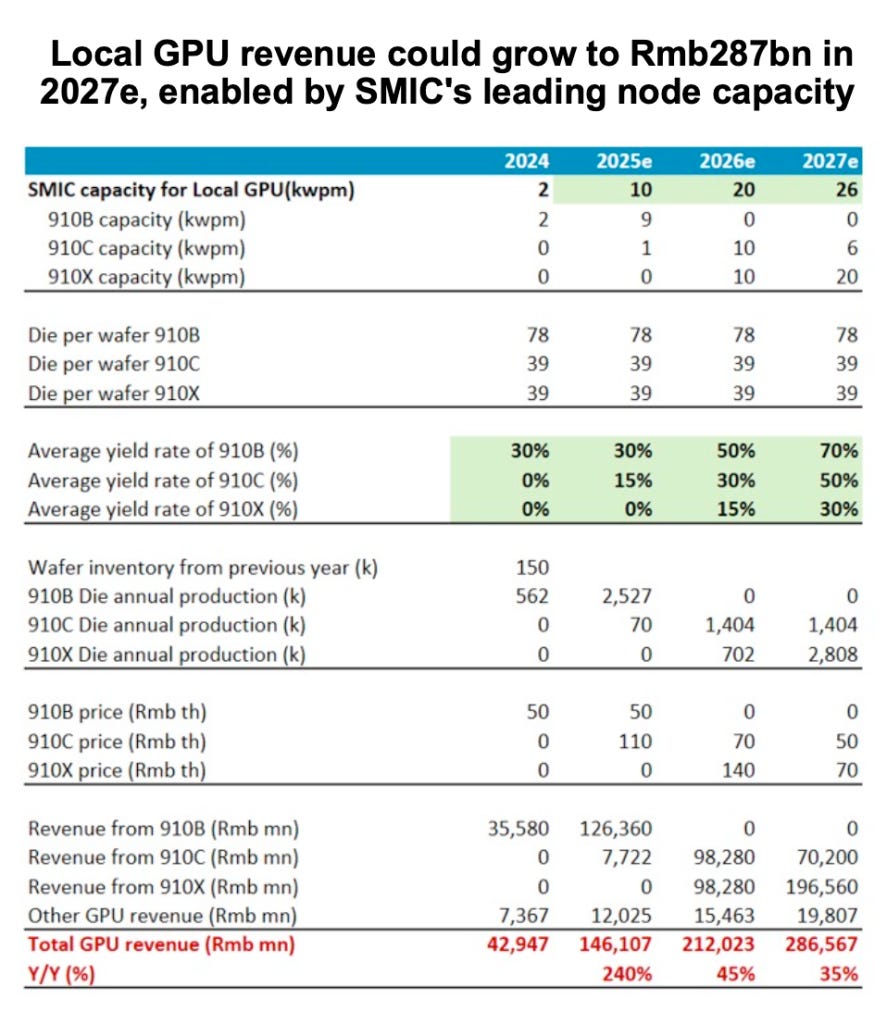

By 2027, Morgan Stanley projects SMIC can produce over 10 million Ascend 910B dies annually.

In what was always a timeline bet, the constraints we assumed would limit Chinese AI development are being overcome.

The Telecommunications Play

Huawei's existing infrastructure provides significant distribution for AI capabilities:

40% of global mobile network equipment

Top-3 smartphone manufacturer worldwide

5G network equipment in 170+ countries

This is the infrastructure for Huawei’s AI play. Every base station of theirs can become an AI inference node. Every smartphone is an edge compute device. Every 5G tower becomes a platform for AI deployment.

While export control debates continue, Huawei is securing partnerships globally, and arrives with a complete package: chips, training, sovereignty guarantees, and integration with existing telecom infrastructure.

Meanwhile, American companies arrive constrained by export restrictions.

Huawei has declared that 6G will be AI-native from inception. Countries running Huawei 5G infrastructure today are establishing the foundation for Chinese AI integration tomorrow. The upgrade path in this case is predetermined.

The American Response: Speed and Scale

A strategic realignment is needed: Accelerate diffusion, don’t rule-make .

A strategic realignment is needed: Accelerate diffusion, don’t rule-make .

As we’ve been saying all along, AI diffusion restrictions create opportunities for Huawei rather than constraining them. Each restriction on American sales pushes would-be customers toward Chinese alternatives. American AI hardware and software should flow freely to many of the markets Huawei is targeting.

Measure the whole picture.

Policymakers and strategists in Washington should measure things like developer adoption, API integration, and edge on-device model deployments rather than just total datacenter capacity.

It’s All About Timelines

The competitive dynamics favor first movers in ecosystem development. Huawei has a significant head start in telecommunications infrastructure. American advantages in chip design and software must be deployed rapidly to maintain our leadership. The Biden administration's export restrictions have created openings for Chinese alternatives.

The Trump administration has so far taken the right steps to reverse course and enable American technology to compete globally. This should continue before Huawei's infrastructure advantage becomes insurmountable.